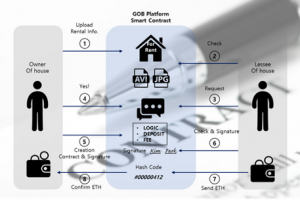

Following our series of articles on smart contracts, we now turn our attention to smart contract audits. Previously, we tapped into what exactly smart contracts were. In fact, we defined them as “sets of digital code created to facilitate the transfer of assets.” We took a dive into their characteristics, caveats and limitations, and their physiology [1][2].

Now that we have introduced the subject of smart contracts, we want to continue by discussing the importance of audits.

What is an audit?

Before discussing smart contract audits, it is worth taking a step back and briefly defining what audits are in general. In traditional markets, audits are commonly known in a financial context; more specifically, they refer to the process of evaluating financial statements (those presented by companies to regulatory bodies). These aim to ensure a certain degree of adherence to the accounting rules of corresponding regions and countries [3].

Defining smart contract audits

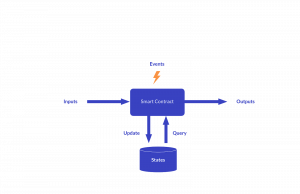

A smart contract audit is similar to a financial audit in the sense that it is a methodical examination and analysis of a smart contract’s code used to interact with a cryptocurrency or blockchain. Basically, smart contract audits are used to prove that the code will work as intended. This process is conducted to discover errors, issues and security vulnerabilities in the code. The importance of smart contract audits is several-fold, and we will be further discussing these below.

Generally, smart contract audits are necessary because most of the contracts deal with financial assets (cryptocurrencies), and can result in sizable losses if exploited by bad actors. Audits include rigorous analysis, and include automated formal verification, static analysis, and manual review.

Benefits

Smart contract audits have a number of advantages. Overall, they provide pre-emptive measures to ensure robust security for unchangeable code.

- Avoid Errors. Auditing code before appending it to the blockchain can prevent potentially catastrophic vulnerabilities after launch. The double-edged sword of blockchain immutability will prohibit changing smart contract errors after broadcasting the smart contract to the network.

- Expert Review. Having dedicated professionals audit the code and help sort cognitive and behavioral biases that are born from auto-verification of code can make an enormous difference on the success of a blockchain project (and set of smart contracts).

- Easy Integration. Current tools are designed to integrate into heterogeneous development environments, in order to perform continuous security analysis.

- Automated verifications. Automatic checks can be set up in order to monitor security vulnerabilities as one writes and changes the code.

- Detailed Analytics Reports. Vulnerability reports with details and mitigation guidance will prepare a project to encounter virtually any attack vector.

Categories

Smart contract audits are a series of processes that check smart contracts. They focus on a variety of categories, including:

|

|

|

|

|

|

|

|

|

|

|

|

Why is it important to audit smart contracts?

By now you might have already thought of a series of use cases for smart contract audits. Being reactive and proactive don’t have to be mutually exclusive. Working on a “solve-as-you-go” basis to stop problems must be complemented by proactive problem seeking and solution design. Don’t just stop hacks, prevent them from happening and make sure that all funds are secured.

Hundreds of cases have struck the smart contract landscape in blockchain, resulting in damages all along the scale. With an estimated US$ 1B of assets stolen in 2018, this level of rigor is the only way to objectively show immunity against some of the most critical and frequent vulnerabilities. Just as the common phrase goes: “A chain is as strong as its weakest link,” the functionality of smart contracts is only as strong as its weakest link. In a fully decentralized world, this has even deeper implications, meaning no authorities to gain the community’s trust, and virtually no do-overs because of blockchain’s immutability.

The smart contract audit process

Similar to audits in the traditional finance space, there are a couple of main types of audits for smart contracts: external audits and internal audits. External audits involve impartial third-party revision of the smart contract, and is the most embraced approach when discussing trust in code.

At Scalable, we break down the audit process into four stages:

- Assessment. During assessment we review the architecture and source code, determine the estimated duration of the audit, and provide a custom quote. The duration depends on a number of factors, including the size of the codebase and its complexity.

- Security Review. During this stage, we review the full codebase and documentation. Our expertise in compilers, consensus algorithms, blockchain node configurations and more allows us to efficiently audit entire dApps, wallets and protocols.

- Reporting. After carrying out a thorough review, a security audit report is prepared, describing in detail the vulnerabilities found as well as recommendations to guard against potential attack vectors. These are categorized in accordance to security level and severity.

- Collaborative Improvement Workshops. Complementary to the security audit report, we provide further assistance by organizing workshops that help implement the detailed recommendations within tight time frames, all in a collaborative manner.

Your SCALABLE Security Solution

Scalable Solutions provides smart contract security solutions to whomever needs it; no matter the size, underlying blockchain of choice, or project complexity.

Our tech, custodial and otherwise, has been, and is being used to custody, trade and move billions of dollars worth of cryptocurrencies. It has been subject to every known attack vector and has remained resilient. Scalable audits is the vehicle to broadcast our expertise to the chosen industry peers. Request a quote for your project today.

Sources

[1] “Smart Contracts and Their Characteristics .” Resources, Scalable Solutions, 7 Apr. 2021, scalablesolutions.io/news/smart-contracts-and-their-characteristics/.

[2] “How Are Smart Contracts Executed? .” Resources, Scalable Solutions, 13 May 2021, scalablesolutions.io/news/how-are-smart-contracts-executed/.

[3] Tuovila, Alicia. What Is an Audit? Investopedia, 19 May 2021, www.investopedia.com/terms/a/audit.asp

References

Mardlin, John. “How to Prepare for a Smart Contract Audit.” ConsenSys, 17 Sept. 2019, consensys.net/diligence/blog/2019/09/how-to-prepare-for-a-smart-contract-audit/.