As digital assets continue to evolve from their original objective – being an efficient form of payment – they are increasingly being seen as investment assets (or securities) rather than payment methods. Some of the reasons behind this lies in their inherent risks, such as price volatility, fraud, and market manipulation. These are also in traditional capital markets. In order to deal with said risks and eventually limit shortfall and exposure to unknowledgeable retail investors, regulations must be drafted and digital asset activity over-sighted. We will further explore regulation considerations for digital asset exchanges.

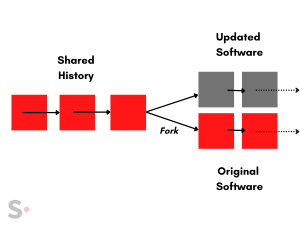

Therefore, the two main paths that can be taken by regulators regarding cryptocurrencies are:

- Add digital assets service providers (i.e exchanges) within the scope of the existing financial services regime. Therefore, the list of financial instruments includes cryptocurrencies, or

- Create an appropriate and proportionate regime that draws on the existing one [1]. Naturally, the decision would ideally be carried out at an international and cooperative level, but is generally done at a country level, directly impacting digital asset service providers that operate in multiple jurisdictions [2].

Digital asset exchanges will have a number of regulatory and fiduciary responsibilities. These include the trading process and the actors involved in it. Furthermore, the extent to which the regulatory institutions (depending on their geography) cover these actors is among them. For example, investors trading through a centralized exchange based in New York are subject to both state and country-level regulations.

Risks and responsibilities of digital asset exchanges

Many of the issues and risks associated with trading on Crypto-Asset Trading Platforms (CTPs) [3] are similar to those associated with trading on traditional trading venues. However, due to the operational models of some CTPs, unique issues and risks arise. This may prompt regulatory authorities to consider new, alternative or tailored regulations for digital asset exchanges, to the extent permissible by law.

The Board of the International Organization of Securities Commissions (IOSCO) – the international body that brings together the world’s securities regulators and develops, implements and promotes adherence to internationally recognized standards for securities regulation – issued a comprehensive document in 2020 encompassing risks and regulatory considerations of digital asset exchanges, tackling the main areas that may have an impact on their objectives, which include protecting investors and ensuring that markets are fair, efficient and transparent [4].

Six key considerations for regulators

Some of the key considerations that regulators must take into account when overseeing exchanges include:

- Access to CTPs and onboarding. Regulatory authorities should analyze how access is provided to CTPs. In this case, determining the extent to which CTPs provide non-intermediated access to investors must be paired with who is responsible for the on-boarding process. Moreover, this includes the execution of the on-boarding process.

- Safeguarding participant assets. Where a CTP holds participant assets, a key consideration for regulatory authorities is how such assets are held and safeguarded. This includes considering what arrangements are in place in the event of a loss, including a loss due to theft from, or the bankruptcy of, the CTP.

- Conflicts of interest. A key consideration for regulatory authorities is the extent to which conflicts of interest exist due to the internal structure and organization of a CTP and, if so, how they are managed. A common conflict of interest includes the funding of order-book depth by the exchange. This creates friction between users and the exchanges’ success.

- Market integrity. Regulatory authorities should consider existing rules relating to market abuse and the capacity of CTPs to prevent and/or detect market abuse.

- Price discovery. Promoting and incentivizing efficient price discovery should be a key characteristic that CTPs should support.

- Technology. Though mostly related to asset security, technology describes the mechanisms used by CTPs to facilitate resiliency, integrity and reliability of critical systems.

Scalable digital asset exchanges

Scalable Solutions swiftly adapts to new circumstances, both technological and regulatory. We have a variety of partners to help our clients navigate the regulatory requirements needed to run an exchange. This presents our clients with a comprehensive strategy to rapidly build digital asset exchanges.

Schedule a demo with our team to find out more about our exchange software and how we can help you.

References

[1] Sotiropoulou, Anastasia, and Stéphanie Ligot. “Legal Challenges of Cryptocurrencies: Isn’t It Time to Regulate the Intermediaries?.” European Company and Financial Law Review 16.5 (2019): 652-676.

[2] In the USA, several federal and state administrative and regulatory agencies keep a close eye on digital assets; including the SEC, CFTC, FTC, IRS, OCC, FinCEN, and more.

[3] The specific denomination of digital asset trading venues can vary depending on a few factors. This can be the jurisdiction, regulatory authorities and determination of specific processes that can be carried out within the exchange. These include trading and/or custody of digital assets. The Financial Action Task Force defines them as Virtual Asset Service Providers (VASPs), while ECB’s AMLD 5 defines them as Virtual Currency Exchange Platforms (VCEPs).

[4] FR02/2020 Issues, Risks and Regulatory Considerations Relating to Crypto-Asset Trading Platforms, Report of the Board of IOSCO. https://www.iosco.org/library/pubdocs/pdf/IOSCOPD649.pdf